38+ 15 year fixed rate mortgage calculator

Yes your mortgage payments are kept the same throughout the loan. Fixed Rate Mortgage Loan Calculator.

G64421mmi023 Jpg

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

. A 15-year fixed-rate mortgage comes with a monthly payment and interest rate that does not change for 15 years. For instance you purchased a house with an introductory 5-year fixed rate at 269 APR. 18 according to Freddie Mac.

30 Year Fixed Rate. For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year. However getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster could still be enticing especially for first-time.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Find average mortgage rates for the 15 year fixed rate mortgage from Mortgage News Daily. Mortgage rates fluctuated greatly so far in the third quarter of 2022 with the average 30-year fixed rate swinging from 570 at the end of June to 513 on Aug.

When a 106 ARM makes sense. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. New data shows that the number of homes to rent in London fell between July last year and July 2022 by 38 and the capital has now entered a landlord-driven market.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. As of August 29 2022 the best high-ratio 5-year fixed mortgage rate in Ontario is 429. Between January 2012 to 2017 the average rate ranged between 334 percent to 453 percent.

The best high-ratio 5-year variable mortgage rate in Ontario is 350. A 30-year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the. Hence my problem.

Unlike mortgage rate surveys. Fixed-rate mortgages FRM and adjustable-rate mortgages ARM. According to the Bank of England since 2016 fixed-rate options are more preferred by borrowers especially first-time homebuyers.

Because of this many consumers find fixed-rate mortgage options more attractive. To compare the most up-to-date Ontario mortgage rates use our rate tables above. As for payment terms the most common ones are 30-year terms.

Mortgage Amount Interest Rate. 238 291 Sep 01 2022 9122. 1540 PM 22nd August 2022 About 2 weeks ago.

Across the United States 88 of home buyers finance their purchases with a mortgage. The average cost of a 15-year fixed-rate mortgage has also increased to 438 as of April 21 jumping 209 year-over-year. Simple Mortgage Calculator.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. You can qualify for an FHA loan if you can make a small downpayment 35 percent of the homes value. Fixed-Rate Mortgages FRM Historically the most widely purchased type of loan is a 30-year fixed-rate mortgage.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. While this isnt the lowest we have seen rates they are definitely on the lower end of what weve seen through the years.

A 15-year fixed mortgage sits at 538 a 296 rise. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. For such individuals a 15-year fixed-rate mortgage may be very appealing.

The loan is secured on the borrowers property through a process. Higher BTL mortgage rate sees landlord profits halve and things could get worse. Using a mortgage calculator is an easy way to find out what your.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Mortgage rates have been all over the board since 1971.

Its used as a loan purchasing tool and is also a popular refinancing product for borrowers. The aim of remortgaging is to secure a better deal than your lenders SVR reversion rate when the introductory period expires. Housing market 15-year fixed mortgages are the second most popular loan product next to 30-year fixed-rate loans.

The Higher Value 4 year fixed LTV interest rate is available to new AIB PDH mortgage customers including Switchers borrowing at least 250000 over a term of 4 years or more. Across the United States 88 of home buyers finance their purchases with a mortgage. The Higher Value 4 year fixed LTV interest rate is available to new AIB PDH mortgage customers including Switchers borrowing at least 250000 over a term of 4 years or more.

In January 2009 the average 30-year fixed mortgage rate dropped by 106 percentage points from 2008. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. After that five-year period if you do not remortgage your loan will automatically revert to the lenders standard SVR.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. FHA mortgages usually come in 15 and 30-year fixed rate terms.

Our Annual Percentage Rate Charges include valuation fees of 150 and 65 and a 60 security release fee at the end of the mortgage term. While most homebuyers choose a 30-year fixed mortgage 15-year fixed mortgages allow you to pay for your loan in half the time. For a 30-year fixed it is 448.

In the third quarter of 2020 912 of all mortgages used fixed-rate loans. The MND Rate Index is the best way to follow day-to-day movement in mortgage rates. This option is appropriate for first-time homebuyers with less than perfect credit scores.

Of course talking to a trusted loan officer about your financial situation and inputting relevant information into a reliable mortgage calculator is the best way to compare the pros and cons of a 106 ARM vs a 15-year fixed-rate mortgage. Our Annual Percentage Rate Charges include valuation fees of 150 and 65 and a 60 security release fee at the end of the mortgage term. But you may also obtain 20-year 15-year and 10-year terms.

The average fixed-rate mortgage was priced at 191. It increased to 509 percent in 2010 but went down to 477 percent in 2011. Today the average mortgage rate for a 15-year fixed rate mortgage is 394.

Mortgages come in two main payment structures.

Free 12 Rate Sheet Templates In Pdf

G64421mmi009 Jpg

Free 9 Loan Spreadsheet Samples And Templates In Excel

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Free 9 Loan Spreadsheet Samples And Templates In Excel

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

Free 9 Loan Spreadsheet Samples And Templates In Excel

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

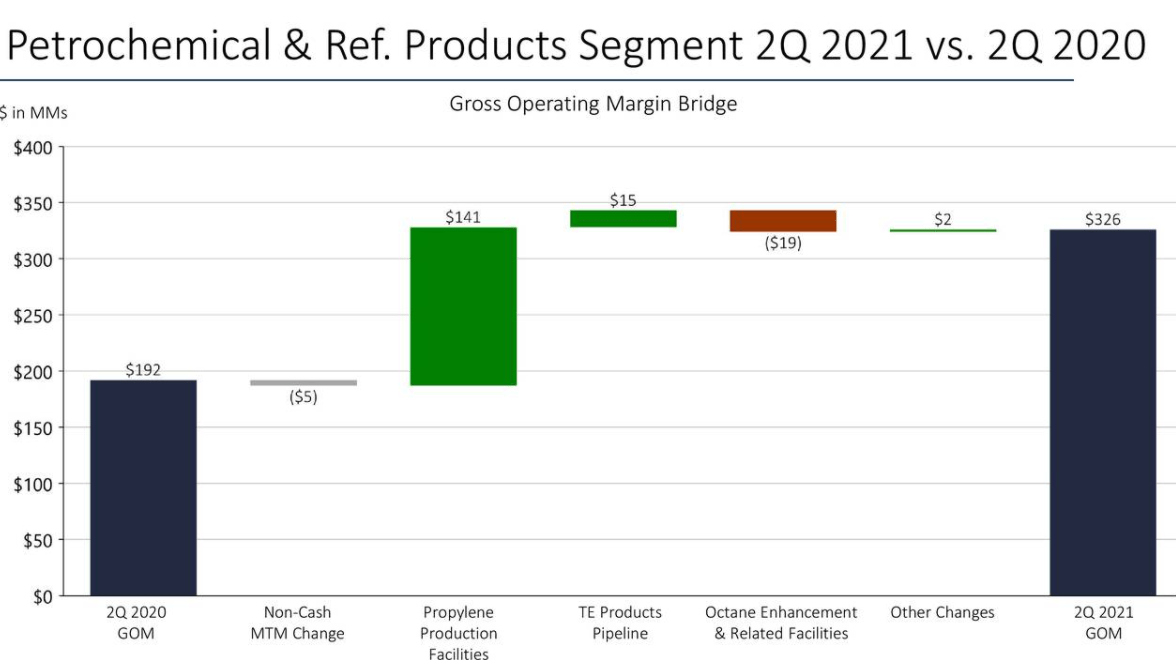

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

2536 Westborne Dr Verona Ky 41092 For Sale Mls 604938 Re Max

15 Year Vs 30 Year Mortgage 30 Year Mortgage Money Management Mortgage Payment

G64421mmi045 Jpg

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

Free 9 Loan Spreadsheet Samples And Templates In Excel

G64421mmi022 Jpg

Free 9 Loan Spreadsheet Samples And Templates In Excel